Here’s an updated list of valid federal and state EV and EVSE incentives for 2017. EV drivers should know about new income caps, upcoming deadlines and funding changes for state and federal income tax credits, rebates, grants and loan programs. Higher-income EV owners may be particularly interested in the commercial incentives listed for each state below. EV buyers who own businesses, invest in commercial real estate or have high level influence at their workplace may be able to benefit more from commercial incentives in certain states.

Here’s an updated list of valid federal and state EV and EVSE incentives for 2017. EV drivers should know about new income caps, upcoming deadlines and funding changes for state and federal income tax credits, rebates, grants and loan programs. Higher-income EV owners may be particularly interested in the commercial incentives listed for each state below. EV buyers who own businesses, invest in commercial real estate or have high level influence at their workplace may be able to benefit more from commercial incentives in certain states.

Tesla Owners

See special conditions that may affect Model S & Model X rebates and incentives in: California, Delaware, Massachusetts and Oregon.

Disclaimer:

The information in this post is provided solely for education purposes. It is not tax advice. Please contact the IRS or consult with a licensed tax professional to make decisions about your personal or business tax situation.

When Does the $7,500 Federal EV Credit Phase out?

The big EV credit is still in play for now. People who buy or lease an electric vehicle can still get up to $7,500 as a tax credit. Remember, a tax credit directly reduces your tax bill.

Expiration:

Federal EV tax credits are phased out after a given manufacturer hits a certain quota. Each major EV manufacturer gets 200,000 electric vehicles subsidized under the program. After that, the tax incentives begin phasing out. Currently, Tesla is in the lead against GM to hit 200k EVs sometime in 2018.

Fine print:

The credit amount is less for certain hybrids. It varies depending on battery capacity and vehicle weight.

Federal EVSE (Charging Station) Rebate — EXPIRED (But There Are Still Great State Rebates)

The feds offered a 30% tax credit against the cost of electric vehicle charging equipment — including both conventional corded and wireless home charging stations. Stations installed before the end of 2016 may qualify for up to a $1,000 tax credit for individuals. Business could recoup up to $30,000 in charger and installation costs. Keep reading for state EVSE incentives still in play.

Expiration:

The federal EVSE tax credit expired December 31, 2016. Sad for anyone who has not yet installed their charger. Great for anyone who purchased and installed a charger during the 2016 calendar year. Go ahead and ask your tax professional if you can get that $1,000 credit towards your 2016 tax bill.

Fine print:

Unused business tax credits can be carried back 1 year or forward 20 years. This could mean that if you still owe business taxes from 2015, this credit could retroactively be applied to the old bill.

2017 EV and EVSE Incentives by State — What’s Still Valid AND Funded

The seventeen states listed below offer tax incentives for electric vehicles and / or charging stations. Many programs are still going strong. Others are listed as valid through 2017 but are technically out of funds and therefore no longer accepting applications.

Jump to State:

Arizona

Arizona Individual Incentive

Residential Electric Vehicle Supply Equipment (EVSE) Tax Credit:

Arizona started small on electric vehicle incentives. A $75 tax credit is available for residential electric vehicle chargers.

Fine Print:

Limit one per household.

California

California Residents Can Claim up to $2,500 in Cash Rebates for Electric Vehicles with Individual EV and PHEV Incentives — Special Deadline for Tesla Owners

Clean Vehicle Rebate:

The golden state continues its strong support for electric vehicles. For individuals, the state offers a $2,500 rebate. Rebates are great because they are paid directly by check. For people who don’t make enough to owe $2,500 in taxes in the first place, a rebate is a much better financial incentive.

Fine print:

There’s an income cap. See table:

| California EV Rebate Income Caps | |

|---|---|

| November 1, 2016* – Present | • $150,000 for single filers |

| • $204,000 for head-of-household filers | |

| • $300,000 for joint filers | |

| March 29, 2016 – October 31, 2016* | • $250,000 for single filers |

| • $340,000 for head-of-household filers | |

| • $500,000 for joint filers | |

| Prior to March 29, 2016* | • Not Applicable |

*Special Deadline Note for Tesla Owners:

For Tesla vehicles ordered prior to March 29, 2016, the vehicle order date will be considered the date of purchase or lease. For Tesla vehicles ordered on or after March 29, 2016, the date of first registration with the California DMV will be considered the date of purchase or lease.

Expiration:

The California Clean Vehicle Rebate expires when funding is exhausted. Based on recent EV sales that could be as soon as the second quarter of 2017. Note: As of May 2017 this rebate still appears to have funding available.

California Business Owners and Commercial Landlords Can Get up to $75,000 Back on Guaranteed EV Charging Station Loans

California Capital Access Program (CalCAP):

Do you exceed the income cap for the California rebate? If you’re a business owner or a commercial land owner you may still benefit from another tax incentive program. California offers an EV infrastructure loan guarantee program that includes a rebate for the borrower. Business owners can get up to 15% back as a rebate on loans up to $500,000. That’s as much as $75,000 back.

Expiration:

The California charging station loan guarantee program is set to continue until funding is exhausted. CalCAP staff confirmed that there is still currently funding available for the program.

Fine print:

- Business owners must pay the loan back with no more than one payment more than 30 days late.

- Employers must have at least 15 employees.

- Commercial buildings must be in designated disadvantaged zones.

Get incentive updates as they happen

Colorado

Colorado Wins for Highest State Tax Credits

Innovative Motor Vehicle Tax Credit:

Colorado offers big, bold EV incentives. The 2015-2016 incentive amount is calculated on a formula based on the MSRP of the vehicle. See the “fine print” section for details. The bottom line is that Colorado residents who bought or leased an EV or Plug-in Hybrid Electric Vehicle (PHEV) in 2015-2016 can qualify for a tax credit of up to $6,000.

In 2017, the formula is eliminated and the max tax credit was reduced slightly. But it’s still hefty. This year Colorado EV and PHEV buyers may claim a flat tax credit of $5,000. Combined with the $7,500 federal rebate it’s one heck of a kick in the IRS’s bill. Of course, you’d need to have high enough income that your tax liability is higher than the credit amount.

Expiration:

The Colorado EV / PHEV tax credit expires January 1, 2022.

Fine print for 2015-2016:

- Colorado EV tax credit formula: [(MSRP or Used Vehicle Price) – (Any other available grants and/or tax credits)] x [(Battery capacity in kWh)/100], up to $6,000.

- Credit formula can be applied to new and used EVs and PHEVs.

- Other available grants and rebates must be applied in the formula, even if they are not claimed.

Colorado Business Can Get $3,260 – $16k Funding Per Charger with Colorado Commercial Incentives

Charge Ahead Colorado:

“Wow!” That might be your reaction to Colorado’s charging infrastructure incentives. Between the Colorado Regional Air Quality Council and Colorado Energy Office there is some serious money to be had.

Together the agencies will fund 80% of the cost of of EVSE up to the following set maximums:

- Level 2, Single Port Station: $3,260

- Level 2, Dual Port Station: $6,260

- Level 3, Single Connection Standard Station: $13,000

- Level 3, Multiple Connection Standard Station: $16,000

Expiration:

The next application round runs January 23rd to February 23rd. The last is May 15th to June 15th. Projects need to be completed and expended by June 30, 2017.

Fine print:

- Projects must seek approval for funding through the application process before charging stations are constructed. Funding is not applied retroactively.

Subscribe to Plugless to get notified about changes to EV incentives in your state

Delaware

Delaware EV Drivers Can Get up to $3,500 Spending Money With Individual EV & EVSE Incentives — Less for Tesla & Other Luxury Electrics

Clean Vehicle Rebate:

Delaware’s Division of Energy and Climate offers some of the best state-level incentives in the country. Delaware EV shoppers can get a check in the mail for up to $3,500 for the purchase of a qualifying battery electric vehicle. Check out the table below for details:

| Delaware EV and PHEV Rebates 2017 | |

|---|---|

| Vehicle Type | Rebate Per Vehicle |

| Battery Electric Vehicles | $3,500 |

| Plug-in Hybrid Electric Vehicles | $1,500 |

| Converted BEV or PHEV | $1,500 |

| BEV or PHEV with MSRP >$60,000 | $1,000 |

Expiration:

The Delaware EV / PHEV Rebate expires June 30, 2018 or when funding is exhausted, whichever comes first. As of the writing of this article DNREC staff confirmed that funding is still available.

Fine print:

- Tesla drivers get slightly less. Note in the table above that electric vehicles with an MSRP of over $60,000 get a lower rebate. $1,000 vs the $3,500 for someone who purchases, say, a Nissan LEAF.

- Lessees must have a lease agreement of at least 36 months to get the rebate.

- Qualifying vehicles must be purchased between Nov 1, 2016 and June 30, 2018.

- Limit 1 vehicle rebate per individual or 6 vehicle rebates per business.

Delaware Residential EV Charging Equipment Rebate Program:

Delaware residents can get 50% of the cost of Level 2 EV charging stations, up to $500.

Expiration:

The Delaware Residential EVSE Rebate expires June 30, 2018 or when funding is exhausted, whichever comes first. As of the writing of this article DNREC staff confirmed that funding is still available.

Fine Print:

Rebate applies of the cost of the physical charging station only. It does not include installation, electrical or other related costs.

Get a Check for up to 75% of Charger Costs with Delaware Commercial Incentives

Delaware Commercial EV Charging Equipment Rebate Program:

Business owners that install a commercial charging station (pay-per-use) in Delaware may be eligible for a rebate of 75% of charger costs, up to $2,500.

Workplace chargers can come with an even bigger rebate. An employer who provides workplace charging may qualify for up to $7,500 back as a rebate.

Expiration:

The Delaware Commercial EV Charging Equipment Rebate expires June 30, 2018 or until funding is exhausted, whichever comes first. As of the January 2017 DNREC staff confirmed that funding is still available.

Fine Print:

- Applies to the cost of the physical charging station only. It does not include installation, electrical or other related costs.

- Dual-headed chargers are counted as two chargers under the rebate program.

- Limit 6 charging station workplaces per business.

- Employers must have at least 15 employees to qualify for the workplace charger rebate.

- Workplaces must be non-residential.

Washington, D.C.

$19k to Go Green in the District of Columbia (Washington, D.C.) Individual EV and EVSE Incentives

The D.C. Alternative Fuel Vehicle Conversion Credit:

D.C. doesn’t offer a direct incentive for purchasing a mass-produced electric car, but DIYers can get a big tax break. Washington, D.C. residents can get a tax credit of up to $19,000 per vehicle converted to alternative fuels, including electricity.

Expiration:

The D.C. EV Conversion Tax Credit expires December 31, 2026. Stay updated by subscribing to Plugless.

Fine print:

- Includes equipment and labor costs.

The D.C. Alternative Fuel Infrastructure Tax Credit:

There are still EV incentives available to D.C. residents. Neighbors of Capitol Hill can get a tax credit for 50% of EVSE and installation costs, up to $1,000.

Expiration:

The D.C. EV / PHEV tax credit expires December 31, 2026. Or the time at which a given administration changes the law. Stay updated by subscribing to Plugless.

Fine print:

- Any unused portion of the tax credit may by carried forward up to 2 years.

$10k to Get Charging In Washington, D.C. With Commercial EVSE Incentives

Public Charging Station Tax Credit in Washington, D.C.:

Publicly available charging stations in D.C. can come with even bigger tax incentives. Up to 50% of costs up to $10,000 can be claimed as a tax credit for public charging stations. There does not seem to be a clause excluding chargers at residential buildings. It may be possible to get a larger tax credit if you make your home charger available for public charging in the District of Columbia.

Expiration:

The D.C. EVSE tax credit expires December 31, 2026. Or the time at which a given administration changes the law. Stay updated by subscribing to Plugless.

Fine print:

- Any unused portion of the tax credit may by carried forward up to 2 years.

Get incentive updates as they happen

Georgia

Pay It Forward — Tax Credits Can Carry Forward Up to 5 Years With Georgia Individual EV Incentives

Low-to-No-Emission Vehicle Tax Credit:

The Georgia tax credit for personal low-emission vehicles was discontinued in 2015. However, the credit is redeemable retroactively depending on your lease or purchase date. Drivers of low-emission vehicles in Georgia may qualify for a tax credit for 10% of the vehicle cost up to $2,500. Zero-emission vehicles can come with even larger credits: 20% of vehicle cost up to $5,000.

Expiration:

Georgia’s Low Emission Vehicle Tax Credit for personal vehicles expired June 30, 2015. Those who bought or leased an EV in Georgia before that date have 5 years after their date or purchase or lease to redeem the credit.

Fine print:

- Low emissions vehicles must operate solely on alternative fuel to qualify. Hybrid gas-electric or diesel-electric vehicles do not qualify as “low emission” vehicles in Georgia.

- Unused portions of tax credits may be carried forward for five years.

Alternative Fuel Vehicle Conversion Tax Credit:

The Georgia tax credit for alternative fuel conversion is still valid, even though it is often listed together with the discontinued Low/No Emission Vehicle Tax Credit. Georgia taxpayers who convert a vehicle to alternative fuel may qualify for a tax credit of 10% of conversion cost up to $2,500.

Expiration:

Georgia’s Alternative Fuel Vehicle Conversion Tax Credit does not currently have an expiration date set. Of course, this can be changed by the legislature.

Fine print:

- Unused portions of the alternative fuel vehicle conversion tax credit may be carried forward for 5 years.

- Low emissions vehicles must operate solely on alternative fuel to qualify. Hybrid gas-electric or diesel-electric vehicles do not qualify as “low emission” vehicles in Georgia.

- Converted vehicles must be registered in the state of Georgia.

- The Fact Sheet on the tax credit does not specify whether conversion credits apply only to parts or whether it includes labor as well.

Alternative Fuel Medium or Heavy Duty Vehicle (MDV / HDV) Tax Credits:

The Georgia tax credit for alternative fuel MDV and HDV is also still available. Georgia taxpayers who purchase medium or heavy duty alternative fuel vehicles may be able to claim $12,000 per medium duty vehicle or $20,000 per heavy duty vehicles. Up to their tax liability or $250,000, whichever is less. That can make a serious dent in the cost of fleet conversion for Georgia taxpayers.

Expiration:

Georgia’s Alternative Fuel Medium- and Heavy-Duty Vehicle Tax Credit expires June 30, 2017.

Fine print:

- For MDV/HDV Tax Credit, the taxpayer must get pre-approved from the Department of Revenue before turning in tax returns claiming the credit.

- Gross vehicle weight ratio (GVWR) must be 8,500 to 26,000 lbs for MDV and greater than 26,000 lbs for HDV.

- Vehicle must be a new commercial vehicle manufactured by Original Equipment Manufacturer (OEM) and 3rd party equipment manufacturer.

- MDV must be solely fueled by an alternative fuel. This may include hybrid electric drives using alternative fuels. This does not include hybrid electric drives running on gasoline or diesel.

- HDV must be designed by manufacturer to operate on 90% or more of alternative fuel..

- The vehicle must be registered in Georgia and driven at least 75% in the state for at least 5 years.

- The total amount of tax credit limit is the taxpayer’s income tax liability or $250,000, whichever is less.

- No unused portion of credit is allowed against succeeding or prior year’s tax liability.

Georgia Goes Green with up to $2,500 in Commercial EV And EVSE Incentives

Fleet Upgrades to Alternative Fuel Medium or Heavy Duty Vehicle (MDV / HDV) Tax Credits:

The tax credit for alternative fuel medium- and heavy-duty vehicles described above can also be used for businesses. “Affiliate entities” of taxpaying Georgians may qualify for up to a quarter million dollars in tax incentives for purchasing alternative fuel MDV and HDV. See the section just above this one for details.

Charging Station Tax Credit:

Businesses in Georgia may qualify for tax credits to offset the cost of installing electric vehicle charging stations. Non-retail enterprises may qualify for tax credits of 10% of vehicle charger and installation costs up to $2,500.

Expiration:

Georgia’s Charging Station Tax Credit does not have a listed expiration date. The legislature could amend the tax code to set one.

Fine print:

- Chargers must be publicly accessible.

- Chargers must be rated for over 130 volts and must be designed to charge on-road vehicles.

- Chargers installed at individual homes do not qualify.

Louisiana

Louisiana Is Losing the Gas with 100% Home Charger Costs up to $1,500 in Tax Credit — Individual EV And EVSE Incentives

Electric or Plug-In Hybrid Vehicle Purchase Tax Credit:

Louisiana taxpayers may take a tax credit of EITHER 36% of the increased cost for purchasing a plug-in vehicle OR 7.2% of the total cost the vehicle. Either way the tax credit cap is $1,500. Leasing a plug-in vehicle is not mentioned in the Louisiana tax credit description.

Expiration:

The Louisiana Alternative Fuel Vehicle tax credit for individuals was set to increase to a higher tax credit on June 30, 2018, but it went under review by the state senate March 1, 2017. Senator Peacock proposed a bill that would end the credit December 31, 2017.

Fine print:

- Electric vehicles must have a minimum battery capacity of 4 kWh and be rechargeable from an outside source. This applies to the majority of plug-in vehicles on the market. For example, even the Prius plug-in from 2015 has a battery capacity of 9 kWh. That version of the plug-in Prius is one of the lowest battery capacities for popular plug-in hybrids in the US.

- Vehicle must be registered in Louisiana.

Louisiana Electric Vehicle Conversion Tax Credit:

Louisiana taxpayers may qualify for a tax credit of 36% of the costs of converting a vehicle from gas-only to plug-in electric. Up to $1,500.

Expiration:

The Louisiana Alternative Fuel Vehicle tax credit for individuals was set to increase to a higher tax credit on June 30, 2018, but it went under review by the state senate March 1, 2017. Senator Peacock proposed a bill that would end the credit December 31, 2017. Subscribe to Plugless to stay updated on EV news.

Fine print:

- Electric vehicles must have a minimum battery capacity of 4 kWh and be rechargeable from an outside source. This applies to the majority of plug-in vehicles on the market.

Louisiana Electric Vehicle Charging Station Tax Credit:

Louisiana taxpayers may qualify for a tax credit of 36% of the costs of electric vehicle charging station equipment. Up to $1,500.

Expiration:

The Louisiana Alternative Fuel Vehicle tax credit for individuals was set to increase to a higher tax credit on June 30, 2018, but it went under review by the state senate March 1, 2017. Senator Peacock proposed a bill that would end the credit December 31, 2017.

Maryland

Maryland Individual EV And EVSE Tax Incentives — EXPIRED

Maryland Excise Tax Credit:

Funds are currently depleted for the Maryland excise tax credit. The credit waived the vehicle excise tax for car registered in Maryland. The one-time credit saved drivers up to 6% of the vehicle value or at least $640.

Expiration:

The Maryland Plug-In Vehicle Excise Tax Credit was originally set to expire June 30, 2017 but ran out of funds in September of 2016.

Fine print:

- For recently purchased vehicles under 7 years registered in Maryland by non-residents, the excise tax (and therefore credit) varied according to the excise taxes already paid in another state (if any).

- For recently purchased vehicles over 7 years old registered in Maryland the excise tax (and therefore credit) was 6% of the purchase price or $640, whichever was greater.

Maryland EV Charger / EVSE Rebate:

Funds are currently depleted for the Maryland EVSE rebate. Residents could apply for rebates of up to 50% of EV charger and installation costs up to $900 during the run of the program.

Expiration:

The Maryland EVSE Rebate was originally set to expire June 30, 2017 but funds are currently exhausted and have not been renewed.

Fine print:

- Rebates were limited to 1 rebate per individual.

Maryland Commercial EV And EVSE Tax Incentives $7,500 Rebate — EXPIRED

Maryland Commercial EV Charger / EVSE Rebate:

Funds are currently depleted for the Maryland EVSE rebate. Businesses could apply for rebates of up to 50% of EV charger and installation costs up to $5,000 during the run of the program. Retail service stations were eligible for 50% of EV charger costs up to $7,500.

Expiration:

The Maryland EVSE Rebate was originally set to expire June 30, 2017 but funds are currently exhausted and have not been renewed. Subscribe to Plugless and stay updated about new funding opportunities.

Fine print:

- Dual headed charging stations were considered one station under the Maryland Electric Vehicle Supply Equipment Rebate Program.

Massachusetts

E-VIP Savings — up to $7,500 Cash Money for Massachusetts Commercial EV And EVSE Incentives

MassEVIP for Fleet Electric Vehicles:

The Massachusetts Electric Vehicle Incentive Program applies to a restricted set of organizations and requires jumping through a few hoops. It also offers some big rewards. The program helps cities, public universities, and state agencies go green with public grants of up to $7,500 per zero emission vehicle. That doubles the available federal tax incentive benefit for a potential combined tax and cash savings of $15,000 per vehicle! Cities can even apply for a limited number of $750 grants for zero emission motorcycles.

Expiration:

The MassEVIP electric vehicle grants are not currently set to expire, but are awarded to qualified organizations on a first-come, first-serve basis. MassEVIP staff confirmed that there is still funding available as of the writing of this article.

Fine print:

- Vehicles must be on a certain list or acquired by a specific bidding process.

MassEVIP for Fleet Electric Vehicles:

The Massachusetts Electric Vehicle Incentive Program applies to a restricted set of organizations and requires jumping through a few hoops. It also offers some big rewards. The program helps cities, public universities, and state agencies go green with public grants of up to $7,500 per zero emission vehicle. That doubles the available federal tax incentive benefit for a potential combined tax and cash savings of $15,000 per vehicle! Cities can even apply for a limited number of $750 grants for zero emission motorcycles.

Expiration:

the MassEVIP electric vehicle grants are not currently set to expire, but are awarded to qualified organizations on a first-come, first-serve basis. MassEVIP staff confirmed that there is still funding available as of the writing of this article.

Fine print:

- Vehicles must be on a certain list or acquired by a specific bidding process.

Amass up to $2,500 with Massachusetts Individual EV Incentives — Lower for Tesla (Unclear Why)

MOR-EV:

Someone in Massachusetts has fun with acronyms. The Massachusetts Offers Rebates for Electric Vehicles (MOR-EV) program is funded by the Department of Energy Resources (DOER). They are clearly doers. Not just talkers. Massachusetts residents who take action to clean up their cars can qualify for up to $2,500 for the purchase or lease of an electric vehicle.

Rebate amounts vary by model type with little apparent rhyme or reason. A Tesla Model S made in the USA with a 60 kWh battery and $68,000 base price gets a $1,000 rebate in Massachusetts. A Mercedes-Benz S-Class 550e built in Germany with an 8 kWh battery gets you a $1,500 rebate. Go figure.

Expiration:

the MOR-EV program does not currently have an expiration date listed on the program website. A live update of current funding showed a little over a quarter of available funding remained at the writing of this article.

Fine print:

- The rebate applies only to the purchase or lease of new vehicles.

- Deadline Timing May Affect Tesla Buyers: Applications must be submitted within 3 months of the purchase or lease, after taking delivery. This could complicate things for Tesla customers who purchase one one date and receive the car a while later.

Get incentive updates as they happen

Missouri

Show Me the Mula with Missouri Individual EVSE Incentives

Missouri Electric Vehicle Charger Tax Credits:

Missouri residents can offset a variety of costs related to EV charging through the Missouri Alternative Fuel Infrastructure Tax Credit. The Missouri EVSE credit applies to 100% of costs for purchasing, installing and maintaining a personal electric vehicle charging station up to $1,500. Most states include only equipment costs. Virtually every other state caps incentives at a percentages of EVSE costs. For home EV charging Missouri isn’t just the “Show Me” state, it’s the “Show Me the Money” state.

“For home EV charging, Missouri isn’t just the ‘Show Me’ state, it’s the ‘Show Me the Money’ state.”

Expiration:

The Missouri alternative fuel infrastructure tax credit for EV chargers expires January 1, 2018.

Fine print:

- 51% of costs in the rebate claim must have been paid to Missouri contractors, including the cost of the charger itself. This can only be waived if there are no such qualified Missouri contractors within 75 miles of the property cited in the rebate claim.

Up to $20k Per Business With Missouri Commercial EVSE Incentives

Missouri Commercial Electric Vehicle Charger Tax Credits:

Missouri businesses can claim costs related to EV charging as a tax credit. The Missouri EVSE credit applies to 20% of costs for purchasing, installing and maintaining commercial electric vehicle charging stations up to $20,000. Most states include only equipment costs. Missouri’s EVSE tax credit stands out in its coverage of maintenance in addition to equipment and installation costs.

Expiration:

The Missouri alternative fuel infrastructure tax credit for EV chargers expires January 1, 2018.

Fine print:

- 51% of costs in the rebate claim must have been paid to Missouri contractors, including the cost of the charger itself. This can only be waived if there are no such qualified Missouri contractors within 75 miles of the property cited in the rebate claim.

New Jersey

Yes, It Does Pay to Plug in at Work in New Jersey with Commercial (Workplace) EVSE Incentives

It Pay$ to Plug In:

New Jersey’s Drive Green workplace charging grant program, It Pay$ to Plug In, is out of funding at the writing of this article. The program provided grants for workplace chargers for up to $5,000 per Level 2 (240 volt) charging station.

Expiration:

The expiration date for the Pay$ to Plug In workplace charging grant program is not listed on the site but funding is currently exhausted for the program as of the writing of this article. Applications are currently still being accepted and placed on a waitlist.

Fine print:

- Projects must acquire funding before construction.

- Dual-charge or double headed chargers are counted as a single charger.

- There is no limit to how many charging stations a business can apply for.

- There is no minimum number of employees required to apply for a grant.

New York

New York Individuals and Businesses Can Save $5,000 Per Charger with EVSE Incentive

New York EV Charging Station Tax Credit:

Individuals and businesses in New York may qualify for tax credits equivalent to 50% of EV charging station equipment costs up to $5,000 per station.

Expiration:

The New York Alternative Fuels and Electric Vehicle Recharging Property Credit expires January 1, 2018.

Fine print:

- The costs are calculated based on the average cost per charging station.

- Tax credits can be carried forward five years.

- The charger must be used 50% of more in a trade or business conducted in New York State.

New York Individual EVSE Incentive (See above)

New York EV Charging Station Tax Credit:

Business in New York may qualify for the same tax credits described above in the individual EVSE incentive.

Get incentive updates as they happen

Oklahoma

Oklahoma Individuals Can Redeem 45% of Costs in EV Incentives

Oklahoma Alternative Fuel Vehicle Tax Credit:

Oklahoma taxpayers may be able to claim a tax credit for 45% of the additional cost of an EV compared to a similar gas car. The 45% credit also applies to the costs of vehicle conversions. If the difference in cost can’t be determined or if it’s a used vehicle, the state offers a tax credit for 10% of total vehicle costs. In either case, the electric vehicle tax credit cap in Oklahoma is $1,500.

Expiration:

The Oklahoma EV tax credit expires January 1, 2020.

Fine print:

- Used electric vehicles only qualify for a tax credit if a previous owner has not already claimed the credit in Oklahoma.

Oklahoma Business Can Save $2,500 with Commercial EV and Incentives

Oklahoma Alternative Fuel Infrastructure Tax Credit:

Tax credits are available for up to 75% of installing commercial EV chargers in Oklahoma, up to $2,500.

Expiration:

the Oklahoma EV tax credit expires January 1, 2020.

Fine print:

- Charging stations must be bought new.

Oregon

Oregon Consumers Save up to $750 with Individual EVSE Tax Credits

Oregon Residential Energy Tax Credit Program:

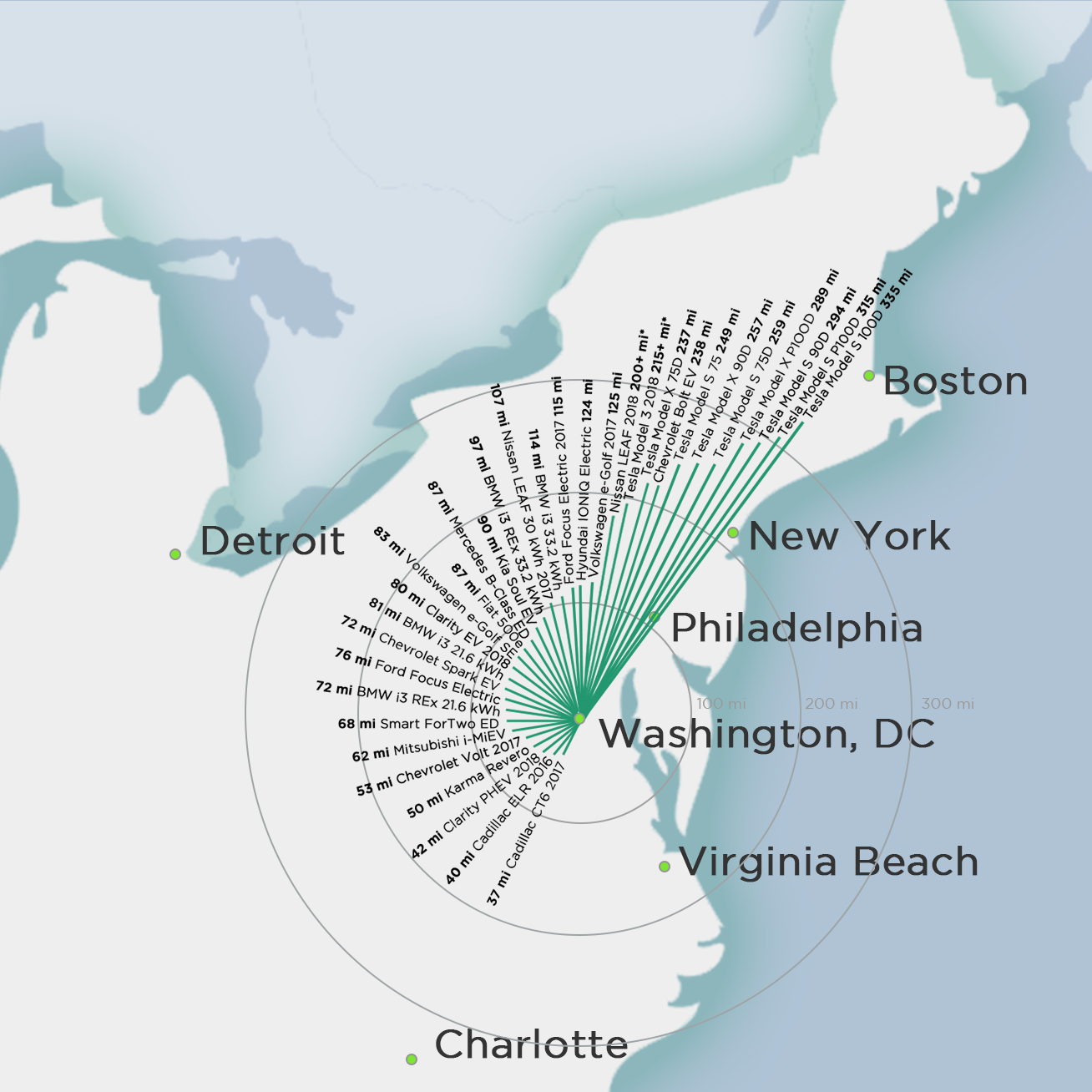

Residents of Oregon have plenty of monetary motivation to go electric. First off, Oregon drivers score the highest fuel cost savings compared to drivers of any other state when switched from gas to electricity. Second, the state offers a tax credit for 50% of equipment and installation for home EV charging stations up to $750. Cha-ching!

Expiration:

The Oregon Individual EVSE tax credit expires December 31, 2017. Specifically, stations must be purchased by December 31, 2017, operational by April 1, 2018 applications no later than June 1, 2018.

Fine print:

- Station must be capable of “recharging a vehicle” within 14 hours.

Up to $8M Per Business: Oregon Commercial EV and EVSE Tax Credits

Oregon Department of Energy Transportation Tax Credits – Alternative Fuel Fleets:

Businesses and other Oregon organizations may be able to take advantage of a major tax benefit for fleet conversion to electric and other alternative fuels. Entities may claim 35% of the cost for replacing or converting gas fueled fleet vehicles with electric vehicles as a tax credit. The credit could be as high as $1.8 million for one fleet conversion or upgrade program.

Expiration:

The Oregon Commercial EV Charger Tax Credit originally expired at the end of their 2017 tax year. Staff at the Oregon Dept of Energy confirmed that funding is still available for the fleet tax credit program as of the writing of this article.

Fine print:

- Organizations must be replacing two or more existing vehicles.

- The tax credit is claimed over five years. Business can claim 10% of the total certified cost in each of the first two years, and 5% for of the last three years.

- The vehicles must be operated at least 75% of the time in Oregon.

- Only certain vehicle types qualify. (Tesla does not produce any of the allowed vehicle types).

Oregon Department of Energy Transportation Tax Credits – Alternative Fuel Infrastructure – EXPIRED:

The Oregon commercial EV charging infrastructure program was originally set to run into 2017 but was closed early as $8M in funding was already distributed. Tax credits were available for 35% of charging infrastructure costs claimed over 5 years.

Expiration:

The Oregon Commercial EV Charger Tax Credit originally expired June 30, 2017 but ran out of funding September 30, 2016. The program is no longer accepting tax credit applications.

Fine print:

- The tax credit is claimed over five years. Business can claim 10% of the total certified cost in each of the first two years, and 5% for of the last three years.

Pennsylvania

Early Birds Get the Worm in Pennsylvania – First 250 EV Drivers to Apply Can Get a $1,750 Rebate

The Pennsylvania Department of Environmental Protection opened up a $1,750 EV rebate program in spring of 2017. It applies to new plug-in hybrid, plug-in electric, natural gas, propane and hydrogen fuel cell vehicles.

Expiration:

The rebate is only being paid out to the first 250 qualified applicants. It ends June 30, 2017 or when funds run out, whichever comes first.

Fine print:

This rebate does not apply to leases of clean vehicles.

Rhode Island

Rhode Island EV Owners Can Get Up to $2,500 in Rebates (but funding is almost out)

Rhode Island DRIVE EV incentives vary by battery size. Teslas get the full $2,500 rebate amount while lower-capacity PHEVs such as Prius Prime qualify for a lower (but still significant) $1,500 rebate.

Expires: The program appears to expire once funding is exhausted. The DRIVE website states that over 94% of funding was exhausted as of 6/6/17, so Rhode Island EV owners should act fast for any chance of claiming the rebate.

Fine Print: Nearly all EVs must be purchased through a qualified RI “franchised dealership” to get the rebate.

Special conditions for Tesla: RI excludes Tesla buyers from the qualified RI franchise dealership restriction, stating “Tesla electric vehicles are exempted from this locational requirement. Instead, qualified Rhode Island residents are allowed to purchase a new Tesla from a licensed franchised auto dealer in neighboring Connecticut or Massachusetts and apply for incentives through DRIVE.”

Washington

Washington Alternative Fuel Vehicle Owners May Be Tax Exempt

Washington Department of Revenue Alternative Fuel Vehicle (AFV) Tax Exemption:

If you’ve purchased or leased a new passenger car, light duty truck, and medium duty passenger vehicle since July 1, 2016, you may be exempt from state motor vehicle sales and use taxes.

Expiration:

Tax exemption expires July 1, 2019 or when the total number of qualifying vehicles titled in Washington on or after July 15, 2015, reaches 7,500 vehicles.

Fine print:

- Your vehicle must be powered exclusively by clean alternative fuels, or a plug-in hybrid capable of traveling at least 30 miles using only battery power.

- Your vehicle must be on the list of qualifying vehicles as determined by DOL.

- The exemptions apply up to $32,000 of a vehicle’s:

- selling price or

- the total lease payments made or

- if the original lessee purchases the leased vehicle before the exemptions expire, the total lease payments made plus the selling price of the leased vehicle.

Get incentive updates as they happen

Why EV Tax Credits Will Nearly All Sunset (And Why That’s Just Fine)

There are still plenty of attractive tax benefits across several states and at the federal level. These incentives make great rewards for the early and midrange adopters of electric vehicles. In the long run, most of them will phase out. And remember, that’s a good thing for all EVangelists.

“An electric vehicle industry that stands on its own two feet embodies the values of independence and self-reliance that sustain the clean energy movement.”

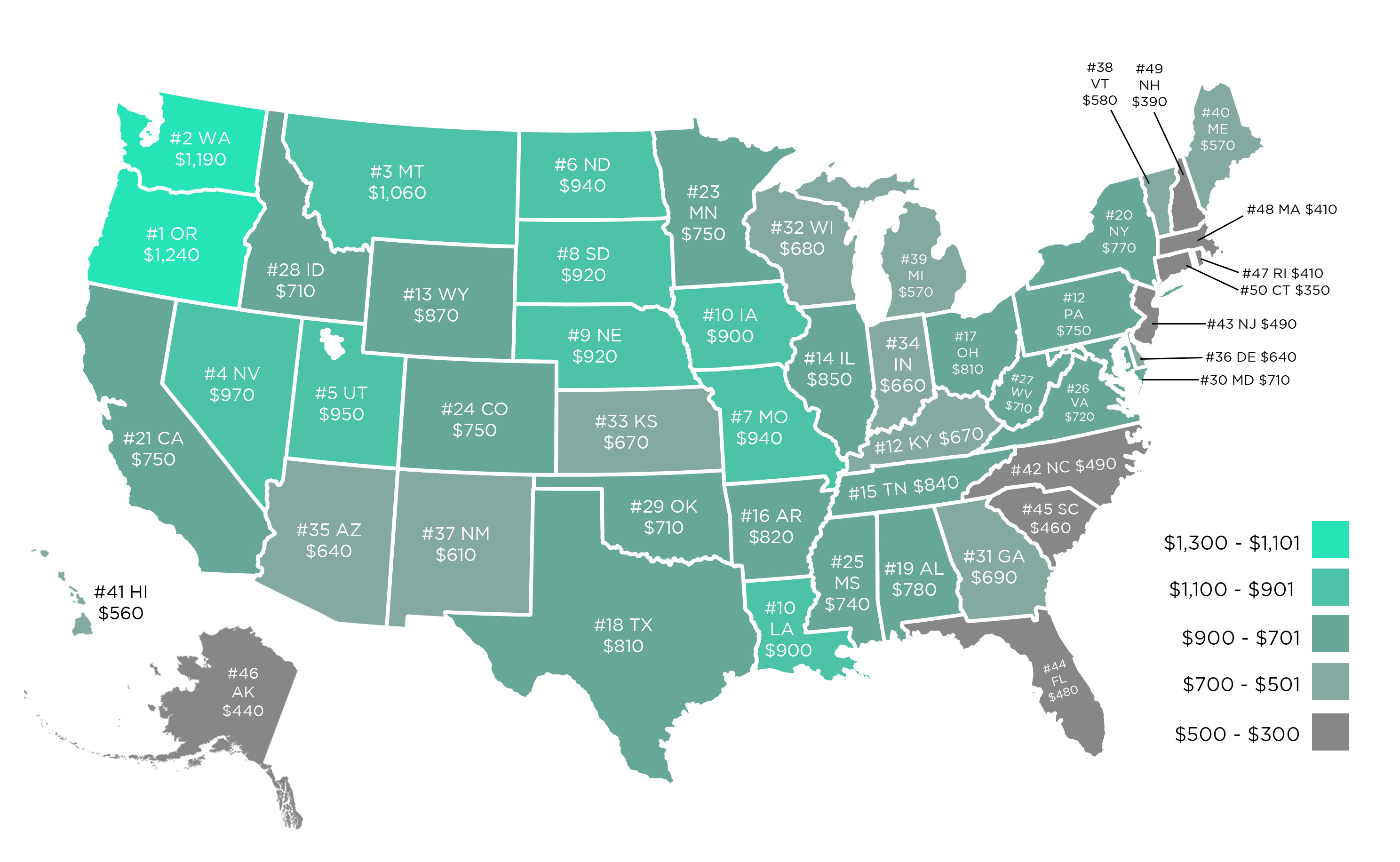

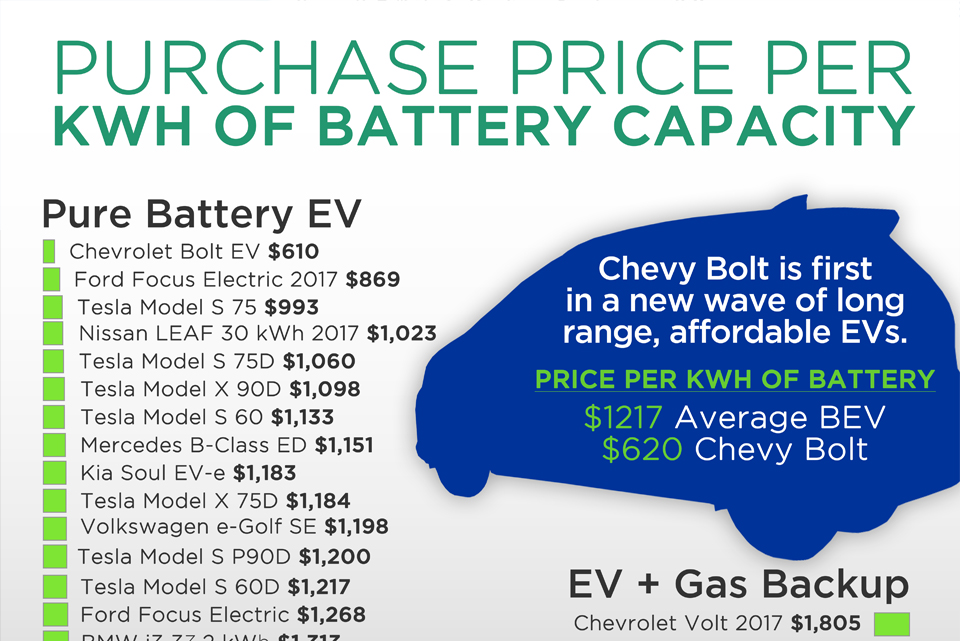

Tax incentives and rebates have played major roles in accelerating electric vehicle adoption. Now, with battery costs down 70% since 2008, electric vehicles are well on their way to rivaling and beating ICE cars in initial price tags. Even without subsidies. Electricity is already a cheaper driving fuel than gas in all 50 US States. And EVs have topped consumer satisfaction rankings every year since 2011.

An electric vehicle industry that stands on its own two feet embodies the values of independence and self-reliance that sustain the clean energy movement.

Get incentive updates as they happen